INNOVATION

What Do Consumers Really Think About Health Care Disruptors?

The pace of disruption in health care is accelerating, with new and familiar players offering a broad range of services and sparking increased competition for hospitals and health systems.

How are these nontraditional options being received by consumers? The 2023 National Consumer Insights Study from Klein & Partners and Core Health answers this question and provides insights into how strategists should respond to the growth of disruptors.

“The trend toward disruption of health care started over 20 years ago in primary care with the advent of retail clinics and, more recently, has expanded into virtual care offerings such as telehealth, eHealth, remote patient monitoring and AI [artificial intelligence]-enabled care,” says Laila Waggoner, a strategic consultant with Core Health. “The trend is also spreading to acute care services like urgent care at home and hospital at home, as well as chronic disease management.”

As the categories of disruption have increased, so has the involvement of other industries. “It’s no longer just the retail sector—now the health insurance and technology sectors are investing heavily in health care,” observes. Waggoner. “We’re also seeing more disruptor partnerships.”

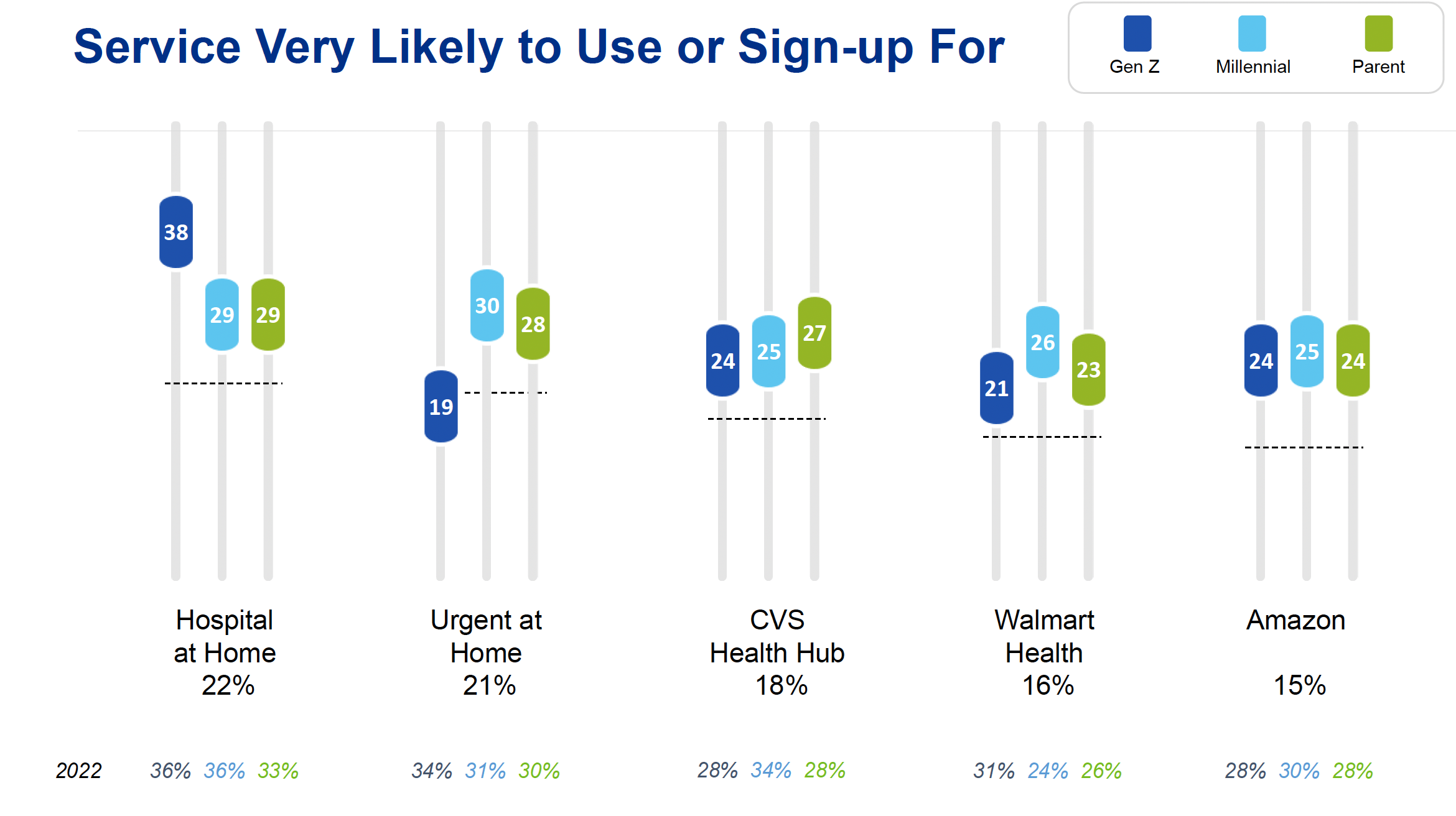

Consumers’ Response to Disruptors

The results of the 2023 National Consumer Insights Study indicate that disruptor models of care are resonating with many Americans. “We learned that today’s consumer defines quality care as being convenient, timely and affordable,” notes Waggoner, adding that disruptors often move faster than traditional providers in delivering on the priorities outlined below.

Convenience

Access to convenient care is vital to consumers, stresses Rob Klein, CEO of Klein & Partners, a firm that specializes in market research and other disciplines. Klein says the study found that the most important factors related to convenience for consumers include:

- Ease in booking appointments (or not being required to have an appointment at all);

- Short wait times;

- Not having to travel to a separate pharmacy to pick up prescriptions; and

- Not having to search for a primary care provider who accepts their insurance.

Timeliness

“Time is the new currency,” says Klein. “The COVID-19 pandemic cost all of us two years of our lives that we can never get back. As a result, time is extremely precious to consumers and many are simply no longer willing to wait, whether it’s for health care or any other service. In fact, a quarter of the people in the study now say they are seriously considering changing primary care providers because of poor service. Just seven years ago, that figure was 10%.

Dean Browell, the chief behavioral officer for Feedback, a digital ethnographic research firm, says he has reviewed countless social media posts by consumers who are frustrated with excessive wait times to see their doctor. “One woman voiced how upset she was after being told she couldn’t get an appointment for a week to be treated for an infection,” Browell says. “She asked, ‘Am I just supposed to wait here in pain?’” Browell says the woman ultimately decided to call a local retail pharmacy clinic where she was seen the same day.

“Many consumers are refusing to settle for the status quo of traditional health care, and they’re sharing their feelings with others on social media where they’re learning about other options available to them from disruptors.”

Affordability

Disruptors are also striking a chord with Americans on medical costs. “In light of sky-high post-pandemic inflation, price is very important to consumers,” Klein emphasizes. “Health systems have to be more sensitive about pricing in this economic climate because people are really hurting financially.”

Klein points out that 24% of study participants say they have searched for medical service prices, and 56% of those who did so chose the most affordable option. “Traditional providers need to realize that they’re in a price war with disruptors,” he explains.

The study also found that transparency in pricing is critical to consumers. “Hospitals and health systems typically don’t reveal prices up front, whereas retail clinics will tell patients exactly how much a service will cost when they walk in the door,” notes Klein. “There is work to be done on this issue.”

Health Care Consumers Want to Be in Charge

Another significant finding from the 2023 National Consumer Insights Study is that consumers want to take more control of their own health care.

“One of the main ways they’re accomplishing this is through online technology,” says Waggoner. “For example, let’s say a mom is concerned she might have COVID. She can use an app to check her symptoms and then make a telehealth appointment to talk to a provider. She can even schedule testing at her local retail clinic—all from the comfort of home.”

Waggoner says disruptors have moved more quickly than traditional providers to empower consumers with these types of online medical resources and tools. That’s noteworthy, she adds, because they equate control over their care journey with a better patient experience.

The Bottom Line

To sum up the results of the study, Browell says that “Traditional providers have a lot of catching up to do in the eyes of today’s consumers.”

Disruptors have higher ratings in nearly every key metric, including ease of access, speed of care, patient control, pricing, transparency and customer service. And one area where hospitals and health systems long thought they had a competitive advantage—quality—is now basically a push, with disruptors’ ratings on par with those of traditional providers.

“Perhaps one of the most important takeaways from the study is that retail has learned health care faster than health care has learned retail,” concludes Waggoner. “And the same is true of tech.”

How should strategists for traditional providers respond to the escalation of disruption in the field? Waggoner, Klein and Browell recommend giving careful thought to the following questions:

- Which disruptions will benefit consumers in your market the most?

- What can you and your organization do to meet consumers’ new expectations?

- How can you and your organization best adapt to the shift in power structure?

- Considering how the COVID-19 pandemic has affected consumers, how might you market differently?

- Are consumers receiving health care or buying health care?

- Is health care about relationships with patients or transactions with patients?

- What business is your organization in? What business should it be in?

- What does your community need your organization to be?