DAT Weekly Trendlines Report – Van Rates Continue to Slip, but Freight Volume Holds Steady

Print this Article | Send to Colleague

| Week Ending Aug. 11, 2018 |

| Van Rates Continue to Slip, but Freight Volume Holds Steady |

|

The national average van rate slipped another few cents lower last week, to $2.18 per mile for the month to-date. The average for July was the second-highest of all time, so the downward trend in August could be a brief hiccup on the way to a new surge in rates for the fall freight season. Van rates are still nearly 23 percent higher than they were at this time last year, and a few cents higher than April and May 2018. One hint is a steady volume of loads moved last week. Load posts declined only 1 percent last week, following a 2.6 percent increase in the previous week. Meanwhile, contract van rates are up to $2.41 per mile including fuel. They’re still rising, which helps to restore a more typical gap between spot and contract rates. As shippers revise their expectations on truckload pricing, 3PLs have an opening to recover gross margins – at least until spot market rates surge again. |

|

|

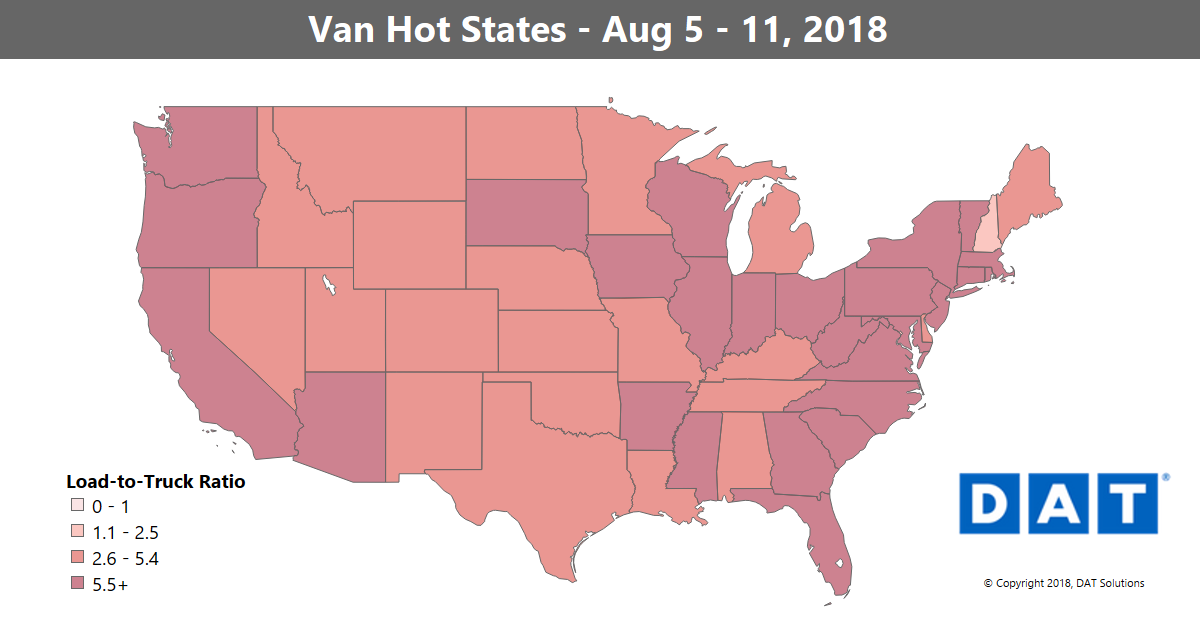

Van rates dropped back to $2.18 per mile as a national average for the month to-date, in the week ending August 11. The national average is nearly 23 percent higher than it was at this time last year, and a few cents above the averages for April and May 2018. The load-to-truck ratio declined to 6.9 loads per truck, with tight capacity in distinct regions along both coasts and in parts of the Midwest. NOTE: The map depicts outbound load-to-truck ratios for dry van freight. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |