DAT Weekly Trendlines Report – Spot Rates Drift Down as Winter Takes Hold

Print this Article | Send to Colleague

| Week Ending Jan. 26, 2019 |

|

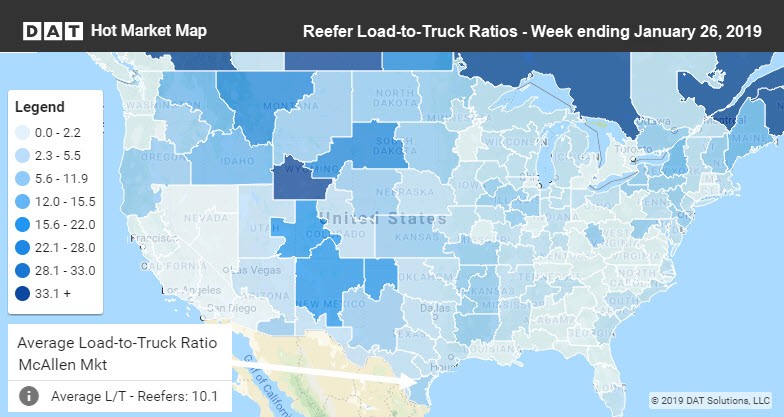

Rates are cooling off for refrigerated freight across the country, but a few hot spots still remain. Out west, California is quiet but competition for trucks can be fierce in the Twin Fall, ID market. Apart from Idaho, most of the seasonal action is in imports. In the Northeast, it could be a challenge to find a reefer truck in the Philadelphia market, where produce arrives from South America. Ditto Elizabeth, NJ, home of the largest seaport on the East Coast. McAllen, TX is an even bigger produce market thanks to the fertile Rio Grande Valley with farms and orchards on both sides of the border. Food processing plants and cold storage facilities abound in the McAllen market, which includes nearby Pharr and Brownsville. The outbound load-to-truck ratio was above 10-to-1 last week, which is almost twice the national average. That additional demand drove rates up to $2.93 per mile last week on the lane from McAllen to Dallas, a 12-cent boost compared to the December average. Rates held steady from McAllen to Chicago, but the lane to northern New Jersey lost traction. Atlanta prices also slipped, but they may pick up this week in the run-up to Super Bowl Sunday. |

|

|

McAllen, TX is a hot market for refrigerated produce grown in the Rio Grande Valley on both sides of the U.S.-Mexico border. Rates rose for reefer loads on the lane from McAllen to Dallas in the week ending January 26. For more spot market freight trends, visit www.dat.com/trendlines. |