DAT Weekly Trendlines Report - Inspection Blitz Adds to Pressure on Capacity and Rates

| Week Ending June 9, 2018 |

| Inspection Blitz Adds to Pressure on Capacity and Rates |

|

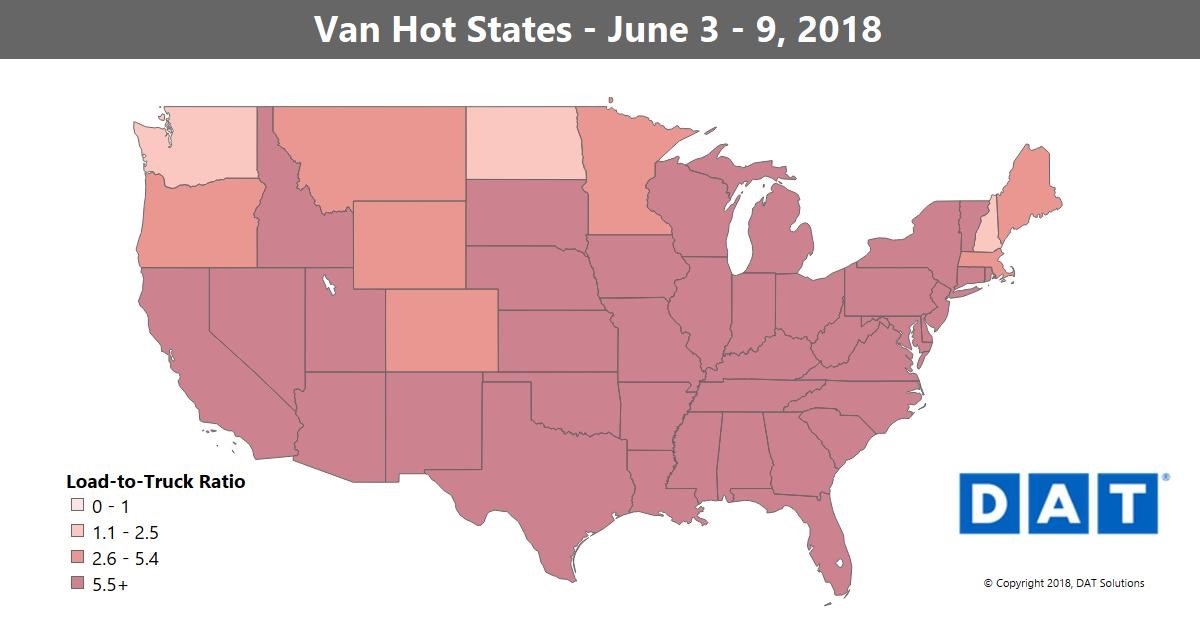

Capacity was already tight, and then came Roadcheck. The annual 72-hour roadside inspection event typically removes some amount of capacity from the road. Some truckers are sidelined by the inspectors, and others take a brief vacation to avoid the hassle. The end result always includes a bump in freight rates, but this year’s Roadcheck Effect was more intense than usual. Van rates jumped a full 10 cents per mile for the month to-date, to $2.29. Expect that number to go even higher before July 4th, as rates rose last week in 81 of the top 100 van lanes, and that basket of lanes has seen a 10 per cent rate increase in just the past three weeks. There are some seriously hot markets out there. Outbound rates rose by at least 2 percent last week in every major market but Seattle. The standouts were Houston, Columbus, and Buffalo, with rate increases above 6 percent week over week, plus Stockton, with a 22 percent increase in volume. Another indicator: The national average load-to-truck ratio soared to 11.3 loads per truck for vans last week. It’s typical for load board activity to increase in the first full week after a holiday, and if all things are equal, both load posts and truck posts would increase by about 25 percent when a five-day week follows a four-day week. Instead, van load posts added 35 percent and truck posts barely edged up 2 percent. |

|

|

The first full week in June included the Roadcheck inspection blitz, which added to capacity pressures as demand for van equipment continues to increase sharply. NOTE: The map depicts outbound load-to-truck ratios for dry van. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |