DAT Weekly Trendlines Report — Van Rates Edge Up, as Load-to-Truck Ratio Declines

| Week Ending June 23, 2018 |

| Van Rates Edge Up, as Load-to-Truck Ratio Declines |

|

Van rates edged up another penny last week, to $2.31 per mile for the month to-date. Yet the national average load-to-truck dropped 11 percent to 9.2 loads per truck. Rate trends typically follow load-to-truck ratios, but in the past two weeks, the ratios are drifting slowly back to earth while rates head in the opposite direction. What’s up with that? For starters, we need to remember that 9.2 loads per truck is a very high ratio, even for the middle of June. It’s 64 percent above last year’s June average of 5.6, which was the highest-ever ratio at the time. Even with the churn in load board activity, however, there was not a big change in the number of loads moved by the end of the week. In our weekly analysis of the Top 100 lanes by spot market volume, the traffic has been steady even as rates rise on two-thirds of those routes. Bottom line: it’s a bit easier to find a truck now, but there aren’t a lot of bargains out there. Meanwhile, shipper-direct contract rates are up 20 percent compared to June 2017, including fuel, but spot market rates are 28 percent higher than last year. For vans, that means carriers get paid about the same for contract or spot hauls this June, while spot rates actually exceed contract rates for reefers and flatbeds. Rail intermodal might seem like an attractive alternative, but those rates are way up, possibly due to scarce drayage capacity and other service challenges. Expect spot market rates to remain elevated through the end of the year, with some seasonal adjustments in July and August. |

|

|

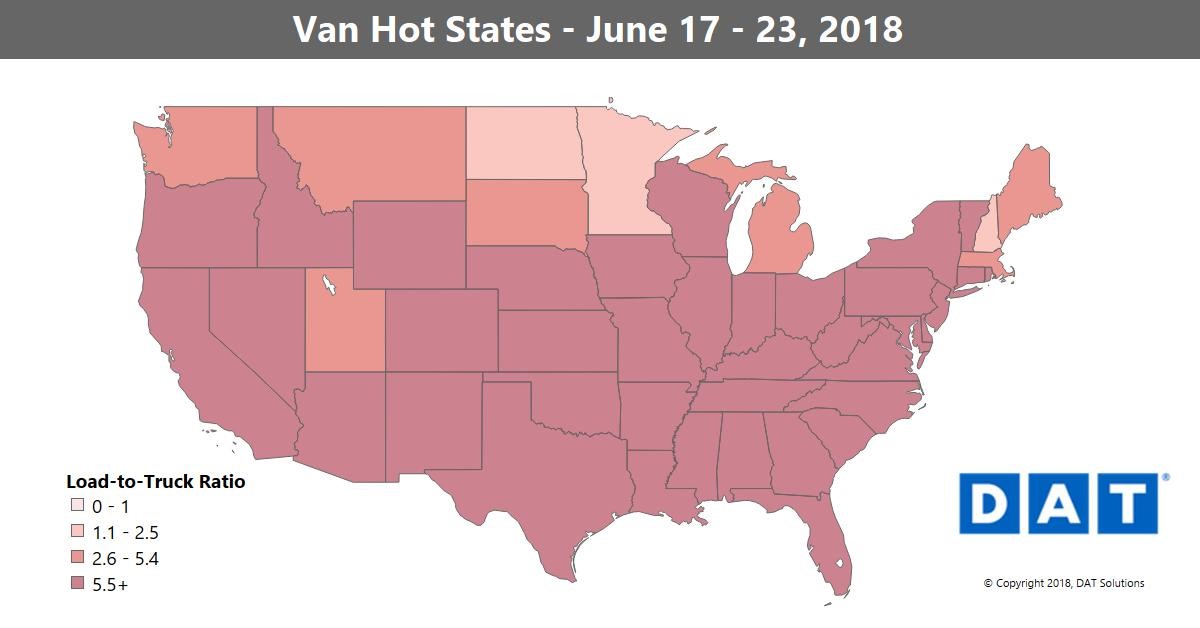

Truck capacity is loosening, but strong demand for van equipment keeps rates and load-to-truck ratios at or near historic levels as the spot market builds to a June peak. NOTE: The map depicts outbound load-to-truck ratios for dry van. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates. For more details on spot market capacity and rates, visit DAT.com/Trendlines |