By Kathy Antonello, FCAS, FSA, MAAA,

Chief Actuary, NCCI

(NCCI Note: NCCI regularly collaborates with industry stakeholders. The use of experience rating modifications [E-mods] by procurement offices is a topic of increased interest. In this piece, Kathy Antonello shares why it is not appropriate to use E-mods to compare the relative safety of employers.)

In some states, contractors have a real challenge when bidding on new business — if their experience rating modification (E-mod) is greater than 1.00, they might be ineligible for the job. Several articles published in recent years have discussed procurement offices’ misuse of E-mods. Despite this, disclosure of E-mods promulgated by NCCI or other rating bureaus continues as a requirement and relative measure of perceived safety practices by contractors bidding on projects.

Following are some of the reasons explaining this improper use:

For Example

A hypothetical, simplified example based on the last bullet above will show how the E-mod is appropriate for its intended use— modifying the manual premium — and how it can easily be misinterpreted if used for other purposes.

If we strip the E-mod formula down to just the basics, we can describe it as a ratio of actual-to-expected losses. That is, we will ignore certain elements like primary and excess losses, weights and ballasts, and credibility. Imagine that there are two construction companies—Employer A and Employer B—doing business in the same state and competing for the same contract. Each has 100% of its payroll in a single class code and therefore both employers are alike with respect to their classification mix. It follows that their expected loss rates (ELRs) from NCCI’s most recent state filing are the same. In addition, the employers have had the same actual loss experience over the last three years. So the two companies are completely identical, with one important exception: Employer B pays its employees 20% higher wages, and thus its payroll is 20% higher. While higher wages usually mean higher indemnity benefits, that is not always true.

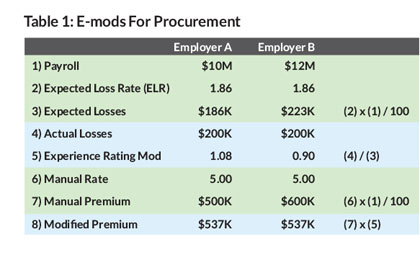

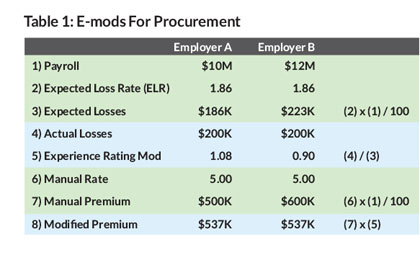

Table 1 shows the calculation of the E-mods for Employers A and B. Employer B has $12 million of payroll, 20% more than Employer A. Both companies were assigned the same single class code and therefore have the same manual rate (5.00) and ELR (1.86).

Expected losses are $186K for Employer A and $223K for Employer B. Note that this does not mean NCCI expects Employer B to have higher losses than Employer A. The expected loss calculation is an intermediate step and an input into the mod calculation. If one were to stop at this point without any context, Employer B could be viewed as "riskier” than Employer A.

The fact that Employer B pays its employees more does not impact its actual loss experience, which is $200K and identical to Employer A. Taking the ratio of actual losses to expected losses leads to an E-mod of 1.08 for Employer A and 0.90 for Employer B. Just as NCCI did not expect Employer B to be "riskier” than Employer A based on expected losses, NCCI does not view Employer A as "riskier” than Employer B simply because it has a debit mod. If one were to stop at this point without any context, Employer A could be viewed as "riskier” than Employer B.

The manual premium is $500K for Employer A and $600K for Employer B. Since Employer B is identical to Employer A, there is no actuarial justification for one to pay more for workers compensation insurance. Multiplying the manual premium by each employer’s E-mod brings their premium to the exact same level.

When the E-mod is used for its intended purpose—as an adjustment to manual premium—the employer with the higher payroll has its manual premium reduced by a credit mod. In this simple example, the credit mod serves to bring the premium for Employer B down to the same level as Employer A—an appropriate adjustment because they have identical loss experience, classification mix, etc. If the E-mods from this example were used for procurement rankings, the employer with the lower payroll would not get the contract—even though it was identical to its competitor and may very well have bid lower because of its lower payroll costs.

In Summary

It’s not appropriate to use E-mods to compare the relative safety of employers. NCCI’s ABCs of Experience Rating guide states, "In general, an employer with better-than-average loss experience receives a credit, while an employer with worse-than-average experience carries a debit rating.” The key words are "in general” and cannot be overlooked, as Table 1 clearly shows.

To learn more, read the ABCs of Experience Rating (PDF), available at ncci.com.

Finally: In 2016, Virginia amended its Public Procurement Act to prohibit procurement officers from conditioning eligibility for a contract on a bidder’s E-mod. NCCI views this as a positive move. We also believe that furthering the conversation on this subject will help clarify how E-mods should and should not be considered in the procurement process.

(C) Used with Permission

Independent Insurance Agents of Virginia