|

||||||||||||||||||||||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | ||||||||||||||||||||||||||||||||

| February 2025 | ||||||||||||||||||||||||||||||||

|

IIAV Member Resources

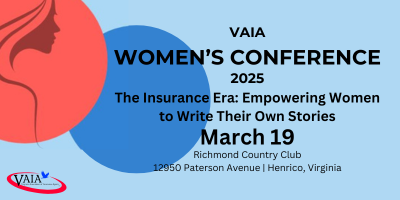

VAIA is excited to announce its Inaugural Women's Conference, set for March 19 in Richmond, VA.

We encourage you to join this new and exciting event, which promises to provide you with great insight into your career in insurance.

IIAV wants to ensure we have the most up-to-date information for your membership.

We would greatly appreciate you taking this 2 – 5 minute survey letting us know your contact information so we can update our records. Thank you for your time!

By Mel Tull

As an insurance agent, you play a crucial role in handling sensitive client information. The Health Insurance Portability and Accountability Act (HIPAA) sets the standard for protecting this information. Understanding your obligations under HIPAA is essential to ensure compliance and safeguard your clients' privacy. This article will provide a brief overview of what insurance agents need to know about their HIPAA obligations.

State & National News

The Big “I" Agents Council for Technology (ACT) recently updated its disaster planning guide. The guide emphasizes the importance of a well-crafted plan to ensure business continuity and effective client service.

With resources, checklists and templates, the guide provides Big “I" members with the tools to prepare for the unexpected.

Download the guide and learn how to protect your business and serve your clients by minimizing damage, maintaining communication and ensuring safety during a crisis.

Photo by Chris Gallagher on Unsplash Food For Thought

As it has been for centuries, the arrival of a new generation into the workforce brings in new uncertainties and challenges for employers. Up until a couple of decades ago, employers generally understood and could expect that a new, inexperienced workforce must adapt to the industry it enters to perform well. Today, however, many executives are concerned that the relationship has been reversed and that, given the labor shortage and the challenges of attracting entry-level workers, the tables have turned, and now industries must adapt to the expectations of the entering workforce to thrive.

Big I Virtual University

In 2021, according to the Insurance Information Institute (III), almost 24% of losses under homeowners insurance arose from water damage (including freezing-related) claims. From 2017 to 2021, III reports that the average claim severity for water damage claims for homeowners multi-peril policies was $12,514. What if some simple homeowner education could help your insureds prevent or reduce costs arising from water damage claims? Read this article for tips on preventing water damage insurance claims.

Question: We issue employees valuable equipment including cell phones and laptops to perform their job duties. Employees also have access to valuable information such as client files. What actions can we take to ensure we get it all back?

The US labor market continues to show resilience as we enter 2025, with strong job growth and wages outpacing inflation. Here are some key data points we are tracking:

If you want to understand the impact of these trends on your workplace in the year ahead, our compensation expert, Susan Palé, is ready to provide personalized guidance. Reach out; we'll help you turn these insights into strategic workforce decisions.

Upcoming Events

Two scholarships are available for first-time attendees. Young agents can apply for the scholarships to offset the cost of attending the 2025 Big “I” Legislative Conference. The Big "I" Legislative Conference

April 30 - May 2

The Westin, Washington, D.C.

Spring is a great time to visit Washington and an even better time to connect with Big “I" independent agents on Capitol Hill. Join us in 2025 for a one-of-a-kind event and get up to speed on the many legislative, regulatory and legal challenges happening to your profession right now. Hear from industry leaders and spend time meeting with your legislators in Washington, D.C.

Breakfast and lunch sessions feature key legislators from both sides of the aisle. Gain a deeper understanding of the issues that impact your business and how you can influence positive change.

YOU can make a difference. Register today to attend the IIABA National Legislative Conference.

|

||||||||||||||||||||||||||||||||