|

||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | ||||||||||||

| March 2020 | ||||||||||||

|

Top 3 Articles

IIAV Member Resources

.jpg) Thinking about your home like a potential buyer can be uncomfortable. Some flaws we don’t notice and others we have accepted. However, when you put your home on the market, these things will affect the final price. It is helpful to take a step back and be objective. Thinking about your home like a potential buyer can be uncomfortable. Some flaws we don’t notice and others we have accepted. However, when you put your home on the market, these things will affect the final price. It is helpful to take a step back and be objective.This same concept can apply to a business. Potential buyers will look at a business as a function of cash flows and risk. Any flaws become a negotiation opportunity. Cash flows get most of our attention, but new entrants, changes in carrier agreements, industry consolidation and new forms of marketing improvement also pose big challenges. The risk aspect of the valuation formula is being challenged by new data-privacy and cyber regulations, reputation risk and InsureTech. These factors affect the potential buyer’s perception of the agency’s value. Think like a potential buyer: How will the new privacy and cybersecurity regulations affect your carriers, suppliers and vendor partners, and how will that impact your product line, service and support and operations? Action item to consider: List three potential risks that, if fixed, would position the agency to be more successful and gain value. David J. Dillon, Principal

What You Can Learn from Jeff Bezos – The Anderson Risk Growth Assessment

The response to my book The Bezos Letters: 14 Principles to Grow Your Business Like Amazon continues to be very gratifying. In addition to being on the Wall Street Journal and USA Today bestseller lists, the book is now published in Korea, Japan, Taiwan, India and Russia. It will be available in an additional eight countries in the next few months. The Bezos Letters was also included on Forbes Top 20 Books You Need to Read to Crush 2020.

State & National News

Boone, N.C. – Jackson Sumner & Associates (JSA) announced the recent promotion of Brantley Saunders to director of marketing for the company. Saunders is a South Carolina native who studied Marketing and Theatre at College of Charleston and has 10-plus years of experience in the insurance industry in various capacities, including E&S underwriting. She also has a background in creative and technology fields. She has served the past eight months as the JSA Marketing Representative for South Carolina.

Global insurance pricing is climbing, with all three major product lines (property, casualty, and financial and professional) reporting rate increases in Marsh’s latest Global Insurance Market Index. In fact, as of September 2019, the broker has reported eight quarters of global insurance price increases in a row.

‘Commonsense precautions’ urged to protect motorists, pedestrians, bicyclists

As vehicle crashes involving pedestrians and bicyclists continue to occur with alarming frequency, law enforcement agencies in the Richmond region and other partners are urging travelers to take simple precautions and to avoid distractions, such as mobile phones and headphones.

IIAV News

Top 10 Reasons to Buy Flood Insurance Now If you have questions about how to use these materials, please contact Ally Barbour at abarbour@iiav.com.

A personal umbrella policy:

Here's a little magic: You can substantially increase your personal umbrella sales and revenue by resolving to ask every customer about their personal umbrella needs! We are starting to receive coverage questions on Coronavirus. The Big I’s Chris Boggs is providing some excellent information on the Virtual University site. Please see below. Also below is some information put together on this topic by the National Association of Insurance Commissioners (NAIC). Please contact Chris and the VU’s “Ask an Expert” if you have additional questions.

The history of Lunsford: A Trustpoint Company is just one factor in its success as a service business

that has helped citizens in the mid-Atlantic region for 150 years. Established in 1870, it is the first and oldest insurance agency in Roanoke. Lunsford offers commercial, personal, life and health policies. Chairman Emeritus, Roy Bucher, said that his firm advocates for its clients by “trying to get them the broadest possible coverage with the broadest services available at the most economical price.” By David W. Tralka

In the great debate over agency valuation, words like “revenue,” “income” and “profit” get tossed around a lot. On the golf course or at industry meetings, owners speak in whispers about the big ones — the agencies that have sold at seemingly impossible multiples. The question is: Multiples of what? What’s the value driver?

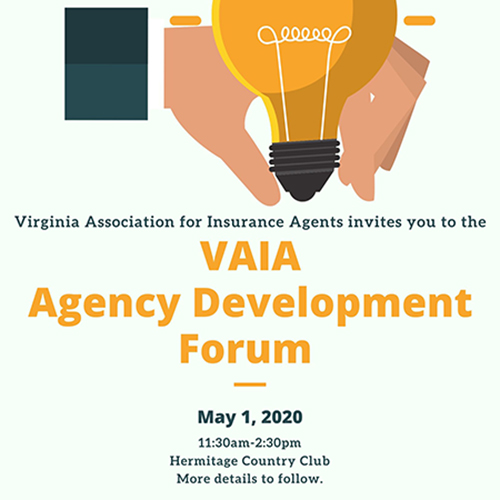

Upcoming Events

We SOLD OUT the 2020 Resource & Solution Center in record time! That means over 76 carriers and vendors are eager to meet, network and help you navigate the future of your agency. Not only will you meet with these incredible professionals but you will hear from keynote speaker Kirk Lippold, Commander USS Cole, learn about emerging agency technology and a number of other relevant and exciting topics. Join us June 24-26, 2020, at the BRAND NEW Marriott Virginia Beach Oceanfront.

Education

IIAV is committed to being Virgina's leading insurance CE provider and we have new content planned for you in 2020! We will continue to provide courses for all agency staff no matter your experience level. Designation courses are back in full force with the MLIS being taught in the classroom this year.

Check out all that 2020 has to offer here! Click learn more to see what's coming up for the first of the year.

From the Desk of the Chief Operation Officer

Recently, I celebrated my 35th year with the IIAV. Any time you reach a milestone in life, you tend to look back and reflect. As I was reading the many heartwarming congratulatory messages I received, my mind began to drift back through time and I took a retrospective look at my career in the insurance industry.

|

||||||||||||

Luck is in the air this month, so why not let your clients know what kind of good fortune they will have with an RLI Personal Umbrella Policy?

Luck is in the air this month, so why not let your clients know what kind of good fortune they will have with an RLI Personal Umbrella Policy?.png)