|

||||||||||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | ||||||||||||||||||||

| May 2024 | ||||||||||||||||||||

|

IIAV Member Resources

State & National News

Harold D. Slemp, IIAV President (1995) and recipient of the IIAV Golden Eagle Award, passed away last month. Harold started his business career with Allstate Insurance in Roanoke, VA, as an underwriter. After a short time, he returned to Marion, VA and assumed the role of insurance agent with Giles and Miles Insurance Agency. Harold eventually became president of Giles and Miles, later incorporating it into Slemp-Brant and Associates. He would remain president of the agency for more than 40 years. He believed the town needed a thriving "downtown" and felt strongly about having a business on Main Street. He really loved being a part of the community and its economy. Harold was not only active as a local insurance agent, he was very active in the Independent Insurance Agents of Virginia ("The Big I"). He served on many state insurance committees and for one term as the chairman of the State Association. In 1997, he was awarded the "Golden Eagle," an award for outstanding contributions to the insurance industry and agent of the year. Besides all that, he was a HUGE Hokie fan.

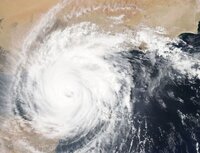

In the 2024 edition of IBHS Rating the States — an Assessment of Residential Building Code and Enforcement Systems for Life Safety and Property Protection in Hurricane-Prone Regions — Virginia finished with a 96, representing the best building code system along the United States hurricane coast. While it did not receive a perfect score, Virginia’s 96 is the highest score in the history of the program.

Photo by NASA on Unsplash CNN

The number of publicly traded companies in the United States is shrinking. Jamie Dimon, one of the world’s most influential business leaders, is worried. At their peak in 1996, there were 7,300 publicly traded companies in the US. Today there are about 4,300. It’s not that America has 40% fewer companies than it did 30 years ago, it’s that companies are increasingly staying private, largely outside the scrutiny of the public eye.

Food For Thought

By Susan Palé, The Workplace Advisors

The Great Resignation is over, the red-hot recruiting market has cooled a bit and inflation is down. That’s some of the good news for employers in 2024. But don’t relax too much — compensation is still important. In a recent Compensation Best Practices Report published by Payscale, a majority of employers reported compensation as their biggest challenge. To address this, it is time to ask some questions.

Question: What do I need to know about hiring a summer intern?

Answer: If you plan to pay your interns at least minimum wage, you’re in good shape. If, however, you are planning to offer an unpaid internship, there are a few things you should consider.

Federal and state governments are cracking down on the use of unpaid interns, arguing that not paying interns for their labor violates the Fair Labor Standards Act (FLSA).

Even if you and your intern agree that the work experience is sufficient compensation for the labor, you must satisfy the requirements for it to be “bona fide” and thus qualify as an unpaid internship.

You may be subject to wage and hour penalties and back wages under the FLSA if you fail to pay your summer interns appropriately.

The Wage and Hour Division of the US Department of Labor’s Fact Sheet #71 offers help for determining whether your intern is entitled to minimum wage or overtime pay and can be found here.

For the record, we are strong proponents of internships, particularly as a means of identifying and developing new talent and future employees. Good luck!

By Mel Tull

The Federal Trade Commission (FTC) recently issued its final rule banning non-compete agreements. The rule is scheduled to become effective on September 4, 2024, unless it is delayed or blocked by the courts. Here’s what insurance agencies need to know about the rule, and what they should do now to prepare for the rule. Photo by Ian Hutchinson on Unsplash

|

||||||||||||||||||||