|

||||||||||||||||||||||||

| Archive | Subscribe | Printer Friendly | Send to a Friend | www.iiav.com | ||||||||||||||||||||||||

| June 2024 | ||||||||||||||||||||||||

|

It's not too late to attend the IIAV Convention and Trade Show on Monday, June 24. IIAV Member Resources

After a state law passed last year, Virginia is joining every state in the U.S. — except New Hampshire — that requires drivers to buy car insurance.

On July 1, all drivers in the Old Dominion must carry coverage, leaving in the dust the requirement that drivers who opted to go without coverage pay an uninsured motorist fee.

As New Hampshire and Virginia were long touted as the only states to not require automobile insurance coverage, personal finance gurus have argued that decision to go without coverage is a bad one and leaves drivers open to liability — a long, winding road involving repair and medical costs — if they are involved in a crash.

Photo by Clark Van Der Beken on Unsplash

State & National News

Insurance Journal

Nearly 80% of respondents to a recent Travelers survey said inattentive driving is more of a problem now than it has been in past years. Travelers noted the pandemic triggered a new wave of dangerous habits. The 2024 Travelers Risk Index cataloged behaviors that have been on the rise since before the pandemic,

House Bill 2451 directed the Virginia Department of Fire Programs to develop training regarding electric vehicle fires and mandated every person engaged in firefighting activities, including volunteer firefighters, to complete the training program by December 1, 2025.

The Electric Vehicle and Lithium-Ion Battery Fire Safety Awareness course will be an online course and will need to be completed individually so it appears on your transcript in Cornerstone OnDemand. This course will be released later this year.

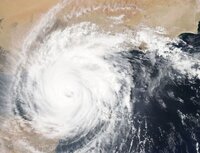

Photo by Roger Starnes on Unsplash Hurricane season is just around the corner, and the State Corporation Commission’s (SCC) Bureau of Insurance (Bureau) reminds Virginians that the time to plan is now. This includes reviewing your insurance policies to make sure you have the coverage you need if a hurricane or other disaster strikes.

Food For Thought

By Paige McAllister, SPHR, SHRM-SCP, The Workplace Advisors

While legal challenges have been requesting an injunction until the question whether the DOL has the right to increase the salary threshold is determined, no such injunction has been issued as of this writing. Therefore, all employers must prepare their response to the new rule which goes into effect July 1, 2024.

Insurance Journal

By Scott T. Freiday Is an ESOP right for your agency’s succession plan? In a recent Insurance Journal article, InsurBanc senior vice president Scott Freiday discusses how an ESOP can be an effective succession strategy for the right insurance agency and outlines the advantage for agency owners with Julius Anderson, president of Anderson Insurance Associates.

Photo by Ian Hutchinson on Unsplash

Question: We allow employees to have their personal cell phones at their desks while they work but we have some who take advantage of this. One employee spends most of the day taking calls from her family and friends while another watches his favorite shows and Tik Tok videos while he is working. What can we do without penalizing those who use their cell phones only when needed?

Photo by Maxim Ilyahov on Unsplash Owning an insurance agency is a great vocation. Inevitably though, all agency owners reach a moment when they begin to think about their agency’s future. It may be due to retirement planning, succession planning, or an unsolicited inquiry from a potential buyer. If you think a sale may be in your future, it's important to begin preparing well in advance. There's a lot to consider. Below are a few areas where advance planning can have a big impact.

IIAV News

We are pleased to announce that Kim Brown has joined our Virginia Financial Services Corporation (VFSC) team effective June 3, 2024 as an Account Executive.

Virginia Financial Services Corporation (VFSC) is the for-profit subsidiary of Independent Insurance Agents of Virginia (IIAV). Its mission is to serve the members of IIAV through the development, implementation and marketing of products and services that benefit its member agents.

Kim comes to us with a wealth of experience and knowledge, and we are looking forward to having her on board. She has worked as a Senior Branch Manager with Liberty Mutual and a Managing Director of P&C for Anchor Insurance Group. Kim graduated from Capella University with a degree in Business Management and Organizational Leadership. She holds CPCU, AAI and AINS certifications. She has experience in sales and coaching and we hope to have her teaching classes before too long. Please welcome Kim to VFSC. She can be reached at kbrown@iiav.com.

Press Releases

As the 2024 Atlantic Hurricane Season approaches, CoreLogic®, a leader in global property information, analytics and data-enabled solutions, released its 2024 Hurricane Risk Report, to help insurers and risk managers prepare for the approaching season. The report found that from Texas to Maine, more than 32.7 million residential properties are at risk of moderate or severe damage sustained from hurricane-force winds. This equates to a combined reconstruction cost of $10.8 trillion. It’s important to note that in the case of a hurricane, not all homes will experience a total loss.

Photo by NASA on Unsplash |

||||||||||||||||||||||||