IIAV Member Resources

With perhaps the exception of ransomware, the largest source of cyber loss for insurance carriers is phishing scams, commonly known as business-email-compromises (BECs), whereby an insured is tricked into sending money by wire transfer to a bank account controlled by a criminal organization. Some losses are seven-figures; some represent death by a thousand wounds. During the last two years, many courts have found for the existence of Computer Fraud coverage for such loss in somewhat complex and sometimes head scratching decisions.

Photo by Markus Spiske on Unsplash

Visit https://www.independentagent.com/vu/Insurance/Commercial-Lines/Crime/MooneyPhishingScams.aspx to view the full article online.

It's clear that many agencies have begun experimenting with the use of AI in a variety of ways. While AI has the potential to greatly enhance agency operations, improve customer service, and create efficiencies, it is important that agencies use AI responsibly, ethically, and in a manner that aligns with the agency’s values and legal obligations. To do that, agencies should adopt a written policy governing the use of AI by agency employees when conducting agency business.

Visit https://www.naylornetwork.com/via-nwl/pdf/AI_Workplace_Policy_for_Insurance_Agencies_(8-12-24).pdf to view the full article online.

State & National News

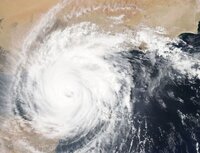

Hurricanes and other natural disasters can take an immense toll on businesses including closures or disruptions that may last for days, weeks or longer. No business is immune to the effects of natural disasters. The State Corporation Commission’s Bureau of Insurance (Bureau) encourages businesses to assess their risk of damage or disruptions from disasters, review their insurance coverage regularly, and adjust it as needed to make sure they have enough coverage to help return their business to operation.

Photo by NASA on Unsplash

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=842755&issueID=96951 to view the full article online.

Food For Thought

The economy continues its solid growth, inflation is lessening, and unemployment remains low. There’s lots going on from a legislative perspective too. As we work our way through Q3 and into Q4, here are some things we think you need to know! The first half of 2024 saw significant job growth, with an average of 255,000 jobs added each month, surpassing the 213,000 jobs added per month in the second half of 2023. In January, 353,000 jobs were added, primarily in professional/business services, healthcare, and retail trade. The healthcare sector continues to lead in job growth, offering numerous opportunities for both clerical and administrative, as well as clinical positions. Visit https://www.naylornetwork.com/via-nwl/pdf/Labor_Market.pdf to view the full article online.

Flood insurance is unusual. A flood policy essentially covers one peril but it is surrounded by many unusual facts and facets that make flood coverage unlike any other. Agents must understand the uniqueness of flood to more effectively present it to clients. With the threats of "atmospheric rivers" growing in California and other western states, reminding your insurance of the importance of flood insurance is only growing.

Visit https://www.independentagent.com/vu/Insurance/Personal-Lines/Flood/FloodResources/BoggsFloodInsuranceFacets.aspx to view the full article online.

Question: We just issued updated handbooks to all employees. We have asked everyone to sign and return the Receipt of the Handbook Acknowledgement form for their files. However, one employee refuses to sign and send it back to us even after we have sent multiple requests and reminders. What should we do?

Visit https://www.naylornetwork.com/via-nwl/pdf/QA.pdf to view the full article online.

E&O Spotlight

“I have E&O coverage,” you may think, or, “It’s just a small claim!” Any E&O claim is a distraction to agency personnel and the agency may take a reputational hit within their community. However, there are many hidden costs of an agency E&O claim that go beyond your deductible. Direct claims cost are just the tip of the iceberg. Let’s cover some of the hidden costs of an agency E&O claim.

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=842569&issueID=96951 to view the full article online.

|