IIAV Member Resources

Best Practices agencies continue excellent organic growth and profitability, according to the 2024 update of the Best Practices Study by the Big “I" and Reagan Consulting, now available on IIABA website. The Best Practices Study analyzes takeaways from nominated Best Practices firms throughout the nation that have been recognized for outstanding management and financial achievement in categories such as income and expense distribution; revenue and profitability growth; sales and service staff compensation and productivity; technology expenses; and property & casualty and life-health carrier representation. Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=847140&issueID=96952 to view the full article online.

The commercial lines multi-state insurance licensing exemption is a significant regulatory provision that simplifies the licensing process for insurance producers dealing with commercial policies across multiple states. This exemption is particularly relevant for property and casualty agencies, which often face the complexity of ensuring their producers are properly licensed in every state where they operate.

Visit https://www.naylornetwork.com/via-nwl/pdf/Understanding_the_Commercial_Lines_Multi-State_Licensing_Exemption.pdf to view the full article online.

State & National News

The Virginia Bureau of Insurance reminds all companies licensed to conduct the business of insurance in the Commonwealth that decisions, conduct, or actions impacting consumers that are made or supported by advanced analytical and computational technologies, including Artificial Intelligence Systems, must comply with all applicable insurance laws and regulations. This includes, but is not limited to, those laws and regulations that address unfair trade practices, unfair claim settlement practices, and unfair discrimination. Administrative Letter 2024-01 sets forth the Bureau's expectations as to how Insurers will govern and manage the risk from the development, acquisition, and use of Al technologies, including Al Systems. This Administrative Letter also advises Insurers of the type of information and documentation that the Bureau may request during an investigation or examination of any Insurer regarding its use of such technologies and Al Systems.

Photo by Steve Johnson on Unsplash

Visit www.scc.virginia.gov/getattachment/3c3e4956-45f1-4c12-ad5c-b55275f29e4b/AL-2024-01.pdf to view the full article online.

A contractor who is not a licensed public adjuster may not engage in the practice of public adjusting by soliciting, negotiating, or effecting the settlement of an insurance claim on behalf of an insured. A contractor who is also a licensed public adjuster cannot act in both roles regarding repairs to a property. Contractors often offer to assist property owners with their insurance claims for repairs to their property. However, some activities may constitute the unauthorized practice of public adjusting. Public adjusters are required to be licensed by the Virginia Bureau of Insurance. (See Sections 38.2-1845.1 and 38.2-1845.2 of the Code of Virginia.)

Visit https://www.naylornetwork.com/via-nwl/pdf/Letter-to-Contractors-Public-Adjusters-7-2024-Final.pdf to view the full article online.

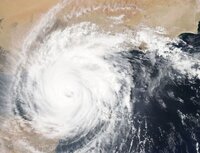

Hurricanes and other natural disasters can happen anywhere and anytime. Each September, National Preparedness Month serves as a reminder about the importance of preparing for such disasters and other emergencies. September also marks the midpoint of the Atlantic hurricane season, the peak period when potentially deadly tropical cyclones form in the Atlantic Ocean. The State Corporation Commission’s (SCC) Bureau of Insurance (Bureau) urges Virginians to assess their risk and act now to protect themselves, their families and their property, both physically and financially. Photo by NASA on UnsplashVisit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=847148&issueID=96952 to view the full article online.

Resources for social media/newsletter content on disaster preparedness September is National Preparedness Month. Use resources found on the national website (including social media elements) to help your clients make a plan to stay safe and communicate during disasters that can affect your community. The Ready Campaign in partnership with the Ad Council is also launching a series of Public Service Advertisements targeted to Asian American, Native Hawaiian and Pacific Islander communities. Those videos are also available on the resource site. Campaign materials are available in a variety of languages, including Spanish. Visit https://www.ready.gov/september to view the full article online.

IA Magazine

As the cyber threat landscape becomes more complex, attitudes toward preparedness against cyber risks is declining. In 2024, 73% of U.S. business leaders feel resilient against cyber risk, a significant long-term decline from 86% in 2022, according to Beazley's latest Risk & Resilience report, “Spotlight on Cyber & Technology Risk 2024."

Photo by Markus Spiske on Unsplash

Visit https://www.iamagazine.com/news/u-s-business-leaders-cyber-confidence-declines-says-beazley-report to view the full article online.

Food For Thought

As cybercriminals continually evolve their tactics, targeting businesses of all sizes, a single breach can expose sensitive data such as passwords, social security numbers and other personal information. This can lead to identity theft, fraud and financial loss. By staying updated on recent breaches, you can take immediate action. Here is a summary of best practices you can follow for security and fraud prevention. Visit https://www.independentagent.com/vu/Insurance/Personal-Lines/Flood/FloodResources/BoggsFloodInsuranceFacets.aspx to view the full article online.

Being nice in the workplace matters. Civility has a tremendous impact on workplace dynamics, culture, and organizational performance. Maintaining a standard of respectful and courteous behavior may seem like a simple initiative, but the costs of incivility in the workplace can be severe. With added factors like remote working environments and the upcoming November elections, prioritizing workplace civility has never been more important.

Visit https://www.naylornetwork.com/via-nwl/pdf/Workplace_Civility_September_2024_TWA_Article.pdf to view the full article online.

Independent insurance agency owners are constantly working both in and on their business. It can be a difficult balance between the demands of client acquisition, retention, and operational efficiency. Growing your agency’s value means more than just increasing its revenue — it involves building a business that is sustainable, scalable, and differentiated in a competitive market. Whether you’re planning for long-term growth or an eventual exit, focusing on key areas like niche development, expanding team capacity, efficiency through the use of technology, and account rounding can position your agency for lasting success. The following are some of the proven ways I’ve seen other agencies increase value. Visit https://www.naylornetwork.com/via-nwl/pdf/Strategies_for_Increasing_the_Value_of_Your_Agency.pdf to view the full article online.

Question: We have some employees who work remotely. We established requirements such as they need to have proper and secure internet access, they need to be able to protect the information of the company and our clients, and they need to be available during certain hours. We found out that an employee has been working from another location for the past month without our approval. What is the exposure and what are our options?

Visit https://www.naylornetwork.com/via-nwl/articles/index-v3.asp?aid=847144&issueID=96952 to view the full article online.

|