Federal Highway Investments Help Drive Capacity Improvements

Print this Article | Send to Colleague

By Dr. Alison Premo Black

ablack@artba.org

From the replacement of the Calcasieu River Bridge in Louisiana to the I-15 Express Lanes in California, states across the country are ramping up investment in projects that expand capacity or provide new roads and bridges, according to ARTBA’s analysis of data from the Federal Highway Administration (FHWA).

|

|

The value of capacity expansion projects has risen since Fiscal Year (FY) 2022, along with the number of projects, roadway miles, and bridges being upgraded.

While major reconstruction and repair remains the primary focus of the Federal-Aid Highway Program – historically representing about half of all construction project costs – states are expanding investments in projects that add new capacity to the highway and bridge network.

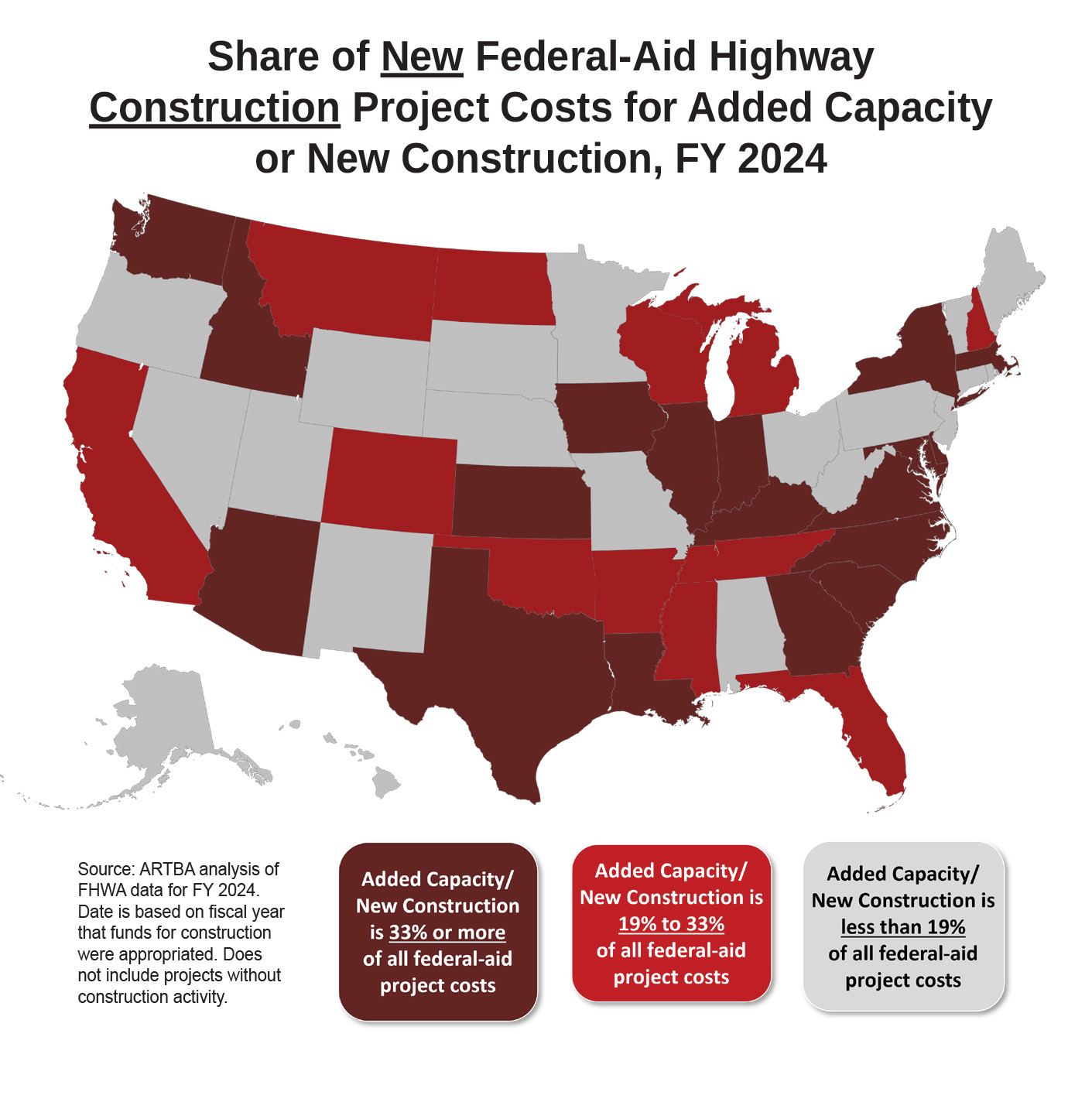

Of the new federal-aid highway projects with construction work authorized in FY 2024, capacity improvements or new infrastructure accounted for 33% of total project value.

This is up from 24% in FY 2022 and 22% in FY 2023. By comparison, these projects accounted for an average of 26% of federal-aid project costs under the previous federal law, known as the Fixing America's Surface Transportation Act (FAST Act) between 2016 and 2020.

States that received the green light to advance major capacity projects last year included Massachusetts, Louisiana, Maryland, Virginia, Delaware, Georgia, Iowa, Texas, Arizona, South Carolina, Idaho, Illinois, and Washington. Capacity improvements accounted for 40% or more of approved federal-aid highway construction project costs in these states.

Such projects could include adding a turn lane, improving interchanges, widening the roadway, or building a new highway or bridge where a structure did not exist before, such as the new interchange at I-95 and Pioneer Trail in Volusia County, Fla. Some may include both adding capacity and new construction, along with additional spending on planning and design work and safety measures.

In addition to federal-aid highway funds, states are leveraging their own state funds and, in some cases, additional private dollars to pay for the capacity projects.

Projects Coast-to-Coast

The number of projects expanding capacity work or new construction between FY 2022 and FY 2024 has grown compared to previous years, with over 4,175 projects authorized to move forward. This compared to 2,750 projects receiving the go-ahead under the first three years of the FAST Act, between FY 2016 and FY 2018.

Every state has had at least one federal-aid highway project that includes expanding capacity since FY 2022, according to the data. This could range from adding a left-hand turn lane as part of Route 1 intersection improvements in Westport, Conn., to construction funding for interchange improvements and widening on I-285 in Georgia.

In FY 2024, states with the most projects that included additional capacity were Indiana, Iowa, Illinois, Iowa, Wisconsin, Michigan, California, Kansas, and Texas.

According to the data submitted by state transportation departments, projects approved since FY 2022 that include some work related to new capacity or construction are expected to improve nearly 7,140 miles (over twice the width of the United States) of roadway overall and 3,800 bridges. In contrast, projects approved between FY 2016 and FY 2018 supported upgrades to just under 5,400 miles of roadway and 2,100 bridges.

Planning & Design Work Points to More Construction

States continue to leverage federal-aid highway funds to prepare projects for construction, with over 20,000 projects receiving approval to commit federal funds to the planning and design (P&D) phase of a project. This is in line with the number of P&D work on projects in the first three years of the FAST Act (19,850 projects) and significantly more than was approved in the previous three-year period, FY 2019 to 2021 (16,400 projects).

It is common for states to receive approval for P&D work for a project and then construction work in the same year or soon after. The uptick in the number of P&D projects is a sign of more work to come over the next few years as construction activity gets underway.

Based on the P&D work approved in FY 2024, bridges will continue to be a top priority, with major P&D commitments for work on the I-95 Bridge Group 4R in Rhode Island, the new Francis Scott Key Bridge in Maryland, the Brent Spence Bridge Corridor in Ohio and Kentucky, the Columbia River Interstate Bridge between Washington and Oregon, and the rehabilitation of the Calumet River Bridges in Illinois.

Dr. Alison Premo Black is ARTBA chief economist.

Editor’s Notes

ARTBA analyzed the flow of federal-aid highway program funds tracked in FHWA’s Financial Management Information System with a focus on the date that projects received the agency’s sign-off for construction or planning and design work. While the federal government does not select projects, they do review projects to ensure they are eligible for the Federal-Aid Highway Program. Projects related to other eligible highway-related expenditures, such as debt service, inspections, research, environmental assessments, or right of way purchases, were excluded.

For this analysis, ARTBA did not include projects that received federal funds as part of COVID or emergency relief. Totals in this article may differ from state-by-state information on ARTBA’s website, which includes all types of federal-aid projects.