General Assembly Update – Battle of the Budget

|

|

| Source: Virginia Public Access Project |

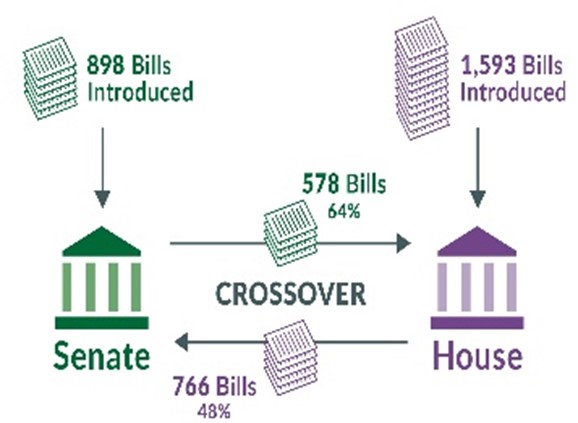

Crossover is at the half-way mark for the General Assembly. At “half time” there are 1,344 bills out of 2,491 introduced. Many in the House attempt to revert what was passed when the Democrats controlled the House over the past two years. A summary of Transportation Construction related bills are below.

Over the weekend, the House and Senate released their separate versions of the State Budget — which is a mixed bag for transportation. (In late January, the Governor released his budget recommendations, including a 1-year freeze on the gas tax and full elimination of the state’s grocery sales tax — both of which are major sources for transportation construction funding at about $250 million and $130 million respectively. The grocery sales tax cut will be forever.)

A recent poll suggests 70% of Virginians support elimination of the grocery tax. (What most of them do not know is what the sales tax tied to groceries pays for.) With that strong of a position, much of the legislature — all of whom will be up for re-election in 2023 — are looking for the political win. It is evident in the comments from the Subcommittee Chairman’s statements on Transportation Funding:

The Senate Transportation Subcommittee Budget stated: “With historic levels of general fund revenues, and significant increases in federal formula funding available through the Infrastructure Investment and Jobs Act, the Subcommittee does not recommend any actions, at this time, to backfill any revenues forgone from our decision to repeal the state-imposed tax on food for human consumption. While this may seem to be a step backwards for long term transportation funding, the decision to eliminate the state share of sales tax on food is a good choice for the citizens of Virginia.” Senate Transportation Committee Report.

- The Senate included $190 million for I-64 widening between Richmond and Williamsburg with the hope they can find the rest of the money from Congress.

- The Senate did not include and blocked a Youngkin-backed proposal to temporarily suspend a 5-cent increase in the per-gallon gas tax and a 6.8-cent increase in the diesel tax. If approved, the plan would reduce transportation revenues by $275 million for fiscal year 2023 before allowing the rates to rise again in July 2023. The Senate did not like the idea of having to come back and vote to “re-instate” the gas tax a year from now.

The House Transportation Subcommittee Budget stated: The proposed budget has “…a $763 million increase for the current fiscal year alone compared to the budget from just one year ago...and includes $1 billion for the following year. This represents an increase of almost 8% compared to what we thought we had available from the current year. Based on the (Transportation) subcommittee analysis, I want to assure everyone that our Transportation programs will not be negatively impacted by the modest tax relief provided to our citizens in House Bills 900 and 1144 that we passed just last week.” House Transportation Subcommittee Report.

- The House included $20 million for I-64 widening between Richmond and Williamsburg for road improvements.

What this means: Now, the two legislative Committees will work to merge the two proposals into one before the March 12 deadline. VTCA recognizes that current funds are sufficient, yet we will continue to express concern for the lack of long-term dedicated transportation funding. VTCA sent a call to action last week and will do so again this week.

VTCA will continue to advocate for long-term dedicated transportation funding and insert the need to study how electric vehicles will play an ever-increasing role.

Transportation Funding:

Gas Tax proposal from the House will now be heard in the Senate but is expected to fail. HB1144 estimates the financial impact of a 1-year freeze to the Commonwealth Transportation Fund:

2023 - $275,500,000 Commonwealth Transportation Fund

2024 - $74,000,000 Commonwealth Transportation Fund

2025 - $25,000,000 Commonwealth Transportation Fund

Grocery Sales Tax Cut is one of the signature pieces of the Governor’s campaign and has bi-partisan support. Virginia is 1 of 13 states that still has a sales tax on groceries. Both legislative bodies see current budget surpluses and Congress’ proposed 5-year Infrastructure funding package as reasons to eliminate the sales tax without a need to backfill transportation funding. If this funding source goes away without backfilling, the net impact to transportation will be a loss of $850 million every six-year plan going forward.

PLA - (HB1091) passed the House and moves to Senate General Laws. It requires every public body, prior to requiring bidders to enter into a project labor agreement, to make a written determination that the PLA is in the publics best interest based on cost, complexity, and other factors.

Wage Theft - (HB889) provides that a contractor, regardless of tier, has a valid defense to a claim for nonpayment of wages if he obtains a written certification from the subcontractor stating that (i) the subcontractor and each of his sub-subcontractors has paid all employees all wages due for the period during which the wages are claimed for the work performed on the project and (ii) to the subcontractor's knowledge, all sub-subcontractors below the subcontractor, regardless of tier, have similarly paid their employees all such wages.

Term Contracts for Engineers - (HB427) provides that the sum of all projects performed in an architectural and professional engineering contract term shall not exceed $10 million, and the fee for any single project shall not exceed $2.5 million. The bill allows a contract for multiple architectural or professional engineering projects to be renewable for up to three additional terms at the option of the public body.

Air, Water and Waste Boards - (HB1206) Air, Water and Waste Boards to be appointed as follows: 2 members appointed by the Governor; 2 members appointed by Senate Committee on Rules from a list recommended by the Senate Committee on Agriculture, Chesapeake, and Natural Resource; and 3 members appointed by the Speaker of the House from a list recommended by the House Committee on Agriculture, Chesapeake, and Natural Resources. Additionally, Boards cannot issue any permit or deny any permit issued by DEQ.

Lower Carbon Concrete bonus - (SB272) Provides a performance bonus for contractors to utilize approved lower carbon concrete products in projects with the Department of General Services (DGS) and the Department of Transportation (VDOT). The bill directs the DEQ to develop, in conjunction with DGS and VDOT, the baseline for determining if a concrete product is lower carbon concrete. The bill requires VDOT and DGS to report annually to the Governor and the General Assembly concerning the use of the performance bonus. The bill also creates a nonrefundable tax credit for taxable years beginning on and after January 1, 2022, but before January 1, 2026, for certain technology implementation costs incurred by concrete producers in the production of lower carbon concrete equal to the amount actually paid by the producer for the technology implementation, up to a maximum of $5,000.

Resiliency in Smart Scale - (HB707) Adds resiliency, defined in the bill, to the list of factors to be considered during the statewide transportation funding prioritization process commonly known as SMART SCALE. The bill also requires that the factors of congestion mitigation, economic development, accessibility, safety, resiliency, and environmental quality be considered relative to the anticipated life-cycle cost of the project or strategy under consideration.

The list of other bills we are tracking can be found HERE.